Bitcoin [BTC] price fails at returning to a bullish sentiments as price fails to hold push above $8000. The funding rate on BitMEX turned negative as the price slipped from $8100 to test lows around $7750, yesterday.

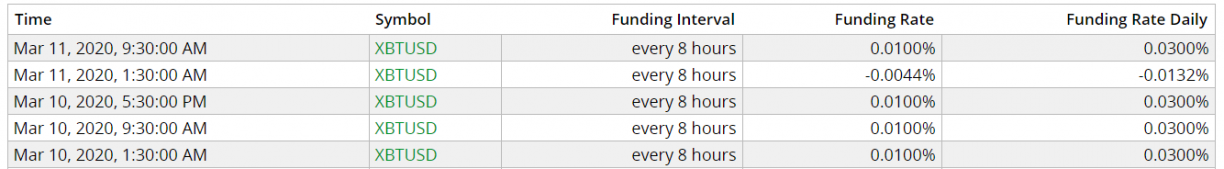

BitMEX funding rate flips negative for the first time since January. On the two prior instances, the bearish sentiments held for less than a day. The rate for the last 8 hours was at the maker price rate of 0.03%, but the Open Interest on the exchange is also witnessing a huge drop.

The price of Bitcoin [BTC] at 4: 00 hours UTC on 11th March 2020 is $7930.

On the other hand, Huobi DM (Derivative’s Market) which was primarily holding short positions from the past couple of weeks is also witnessing a drop in Open Interest (down 54% beginning in March).

The dominance of short order on the exchange has seen a slight drop from 60% to 55% in the last couple of days. This suggests that traders might be taking out profits on their short orders.

Moreover, the convergence of the lowering two sentiments seems to indicate extreme uncertainty in the market.

Black Swan Event

The uncertainty in the price of other assets globally is creating a highly distressed economic environment with massive volatility. Stock price plunge to new yearly lows on Monday as the spread of the virus is now causing extreme fear.

While the stock markets pushed back up yesterday, on whether it is a dead-cat bounce before another drop or a bottom signal is still unclear. The sentiments is similar with BTC as well.

Coronavirus is now been looked upon as a ‘Black Swan’ event having tremendous social and economic impact. During the beginning of this year, the safe-haven analogy along with halving has primed Bitcoin for a bullish run.

On-chain analyst, Willy Woo who tracks the recent investor activity on Bitcoin is seeing an abrupt change vs. its expected behavior. The short term lines (dim blue) where on a rising trajectory along with long term (purple and red) investor activity. This has seen an abrupt drop deviating away from its’ oscillatory structure. He tweeted,

This is a chart of on-chain "investor activity" right now. Long term looks solid. Short term is very weird, normally it's smooth oscillations, not anymore, it's like something hit it (#COVID19?), it's fizzing out. Waiting for this to reverse before we put in a bottom. Maybe soon. pic.twitter.com/uy9gSeE3Ts

— Willy Woo (@woonomic) March 10, 2020

Bitcoin [BTC] price also revived slightly above lows at $7600. However, the bullish resistances remain unfazed.

The 200 Day EMA is currently at $8179, the price will need to break on top of it to begin with the bullish sentiments in the market again. Currently, the parallel support and resistance to price is around $7650-$7700 and $8250-$8300, respectively.

Do you think the effect of the virus on the economy will grow or subside? Please share your views with us.

from Coingape https://coingape.com/bitcoin-futures-funding-bitmex/

0 Comments