Just when you thought it was safe to go back into the stock market, one billionaire bond manager is warning that the other shoe is about to drop. DoubleLine Capital CEO Jeffrey Gundlach reportedly believes that investors are ignoring the warning signals from the economy, with the billionaire asset manager having basically become a canary in the stock market coal mine. Meanwhile, Bitcoin by all accounts is only just hitting its stride.

You wouldn’t know it by looking at the way the stock market indices ended the session, but there’s a good chance that equities have yet to find a bottom, according to Gundlach on CNBC. Nonetheless, the S&P 500, Nasdaq and Dow Jones Industrial Average all closed in the green by more than 1%. But if you ask Gundlach, who has earned the nickname as Bond King, don’t let those gains fool you, telling the business network,

“I’m certainly in the camp that we are not out of the woods. I think a retest of the low is very plausible. I think we’d take out the low.”

The DoubleLine Capital chief has a good point, especially considering the dire unemployment statistics, in which more than 26 million people are now collecting benefits. He said:

“We’ve lost every single job that we created since the bottom in 2009.”

While jobs are being lost left and right in the economy, blockchain startups are chugging along. Cryptocurrency exchange Kraken, for instance, was reportedly poised to hire 250 people this year in anticipation of Bitcoin’s halving event. [Forbes] Now the company has bolstered that outlook to 350 new hires and accelerated the timeline as more investors flock to alternative assets due to the financial impact of the coronavirus crisis. Kraken Co-Founder and CEO Jesse Powell told Forbes,

“The traditional system seems to be completely breaking down all over the world. So, increased customer demand is going to mean increased business for us, and it’s going to mean increased hiring.”

Has the S&P 500 Bottomed?

While Gundlach believes that the bottom has yet to fall out in the stock market, Fundstrat Co-Founder Thomas Lee has a more bullish outlook. According to his firm’s research based on prior financial crises, the broader stock market historically finds a bottom before the economy sees the worst of jobless claims. So even though the last wave of jobless claims was abysmal, the S&P 500 index’s reaction suggests there could be a light at the end of the tunnel. In a tweet, he points to the bear markets of 2001-2003 and 2007-2009, stating,

“The S&P 500 bottomed before jobless claims peaked in 2001-2003 and 2008-2009.”

Bitcoin’s Mojo

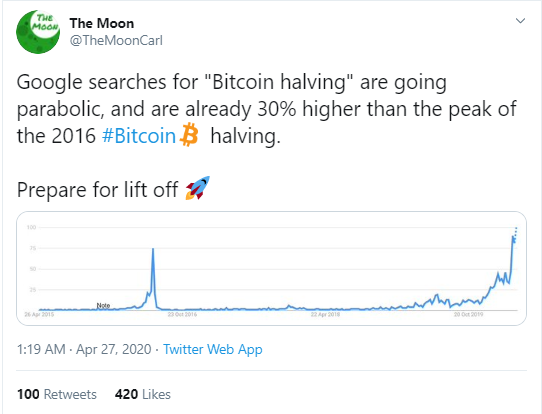

Meanwhile, as the Federal Reserve pumps trillions of dollars into the economy, investors are increasingly on the lookout for a hedge against inflation, like Bitcoin. With the halving countdown underway and the supply of new coins about to slashed in half, the cryptocurrency community has the wind at its back once again. Now that the Bitcoin price is perched above $7,700 and barreling toward $8,000, it’s ushered in a wave of optimism to the market.

Kraken’s hiring spree is evidence of this trend. There are other anecdotal signs, as well. Twitter account “The Moon” (@TheMoonCarl) observed that the Bitcoin halving event is on the radar of Google searches, tweeting,

For his part, Jeffrey the “Bond King” Gundlach has yet to recognize the value of Bitcoin, except to suggest that investors could earn a quick return on occasion.

The post Billionaire Bond Manager Is Canary in Stock Market Coal Mine as Bitcoin Hits Its Stride appeared first on BeInCrypto.

from BeInCrypto https://beincrypto.com/billionaire-bond-manager-is-canary-in-stock-market-coal-mine-as-bitcoin-hits-its-stride/

0 Comments