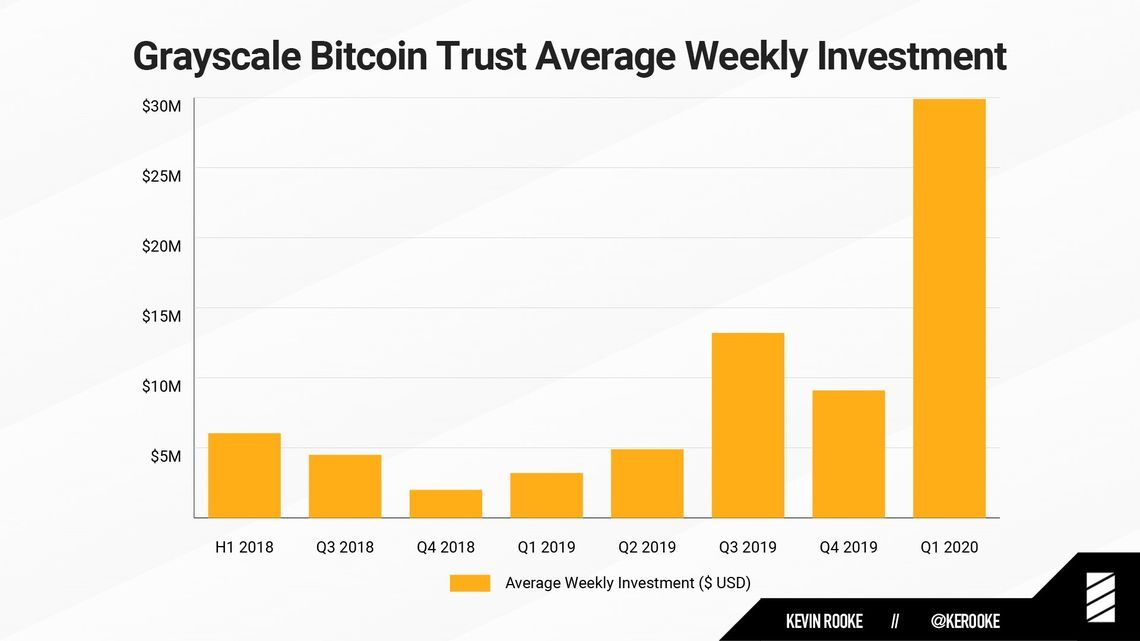

Grayscale Investment’s flagship Bitcoin Trust fund has seen a ten-fold increase in assets under management year-over-year.

The average weekly investment in Q1 2019 was just $3.2 million, compared to nearly $30 million this year.

The growth has allegedly been the result of the arrival of ‘institutional money.‘ Long considered the future hope of Bitcoin and cryptocurrencies, large-scale institutional investors would bring massive investment into the space.

A number of comments in the tweet suggest that the company’s growth is due largely to small-time investors who are learning about cryptocurrencies.

Interestingly, the $30 million figure represents more than half of all Bitcoin mined each week considering only 900 BTC are mined each day now. With block rewards decreasing, Grayscale has been able to purchase such a large percentage.

Grayscale founder and CEO Barry Silbert weighed in on the tweet as well, hinting that the growth looks to be continuing in Q2.

The post Grayscale Bitcoin Fund Assets Grow 10x Year-Over-Year appeared first on BeInCrypto.

from BeInCrypto https://beincrypto.com/grayscale-bitcoin-fund-assets-grow-10x-year-over-year/

0 Comments