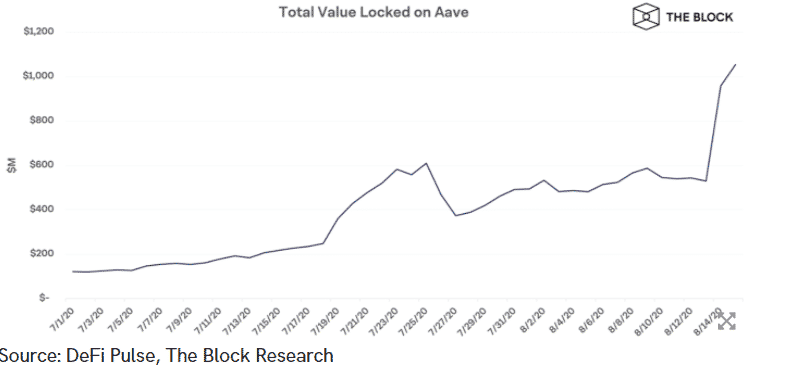

- Aave is the second protocol to hit $1 billion in total locked value after Maker Dao.

- LEND/USD technical picture starts to deteriorate following a barrier at $0.65.

The decentralized finance commonly referred to as DeFi continues to hit new highs as if it’s a rocket heading to the red planet, Mars. Aave, a DeFi project is among the biggest gainers in both the value of the token and the total value of the funds locked in 2020. On crossing the massive $1 billion milestone, Aave has also seen significant growth in the price of LEND, the protocol’s official token. LEND is up 18% in the last 24 hours and trading at $0.6053.

The remarkable performance also comes after the Network announced version two of its protocol bring on board a host of new features such as native under collateralized loans/credit delegation, debt trading and better borrowing rates.

Aave has become the second DeFi protocol to hit $1 billion in the total value locked following MakerDAO. At the moment, around $6 billion of cryptoassets are locked in DeFI as per data provided by DeFi Pulse.

Read more: DeFi Rush In Full Swing As Aave Dethrones Compound

Aave Technical Picture

Aave, as aforementioned, is trading at $0.6053. It has retreated from a weekly high at $0.6654 (as shown on Binance). The technical picture appears to be deteriorating fast as observed with a sharp drop in the level of the RSI. Similarly, the MACD is highlighting the bearish case by extending the negative divergence. If support at $0.60 fails to hold, LEND could easily plunge to test support at the ascending trendline. Extended declines would seek refuge at $0.55, the 50 SMA at $0.5196, the 100 SMA at $0.45 as well as $0.35.

Read also: “Actual” Total Value Locked in DeFi is Only About 50% of Reported Value: Analyst

LEND/USD 4-hour chart

LEND Intraday Levels

Spot rate: $0.6053

Relative change: -0.035

Percentage change: -5.38%

Trend: Bearish

Volatility: Expanding

from Coingape https://coingape.com/73510-2/

0 Comments