- Bitcoin has faltered over the past few days, failing to surmount $12,000 yet again.

- The asset trades at $11,750 as of the time of this article’s writing.

- Despite the pause in the uptrend that persisted all of last week, analysts remain bullish from a long-term stance.

- One prominent investor said that Bitcoin is effectively one of the best trades in the world.

- The investor in question is Raoul Pal, the former head of hedge fund sales at Goldman Sachs and the chief executive of Real Vision.

Almost No Trade Matters But Bitcoin: Ex-Goldman Sachs Exec

Raoul Pal, the CEO of Real Vision, said in a recent interview that he thinks “no trade matters except for Bitcoin” at this moment. He added that “almost everything is an inferior trade” to the cryptocurrency.

This comes shortly after he said that the ongoing money printing is making him more bullish on Bitcoin than ever before:

“In fact, only one asset has offset the growth of the G4 balance sheet. Its not stocks, not bonds, not commodities, not credit, not precious metals, not miners. Only one asset massively outperformed over almost any time horizon: Yup, Bitcoin. My conviction levels in bitcoin rise every day. Im already irresponsibly long. I am now thinking it may not be even worth owning any other asset as a long-term asset allocation, but that’s a story for another day (I’m still thinking through this).”

Pal isn’t the only macro analyst to have been pledging their support for Bitcoin over recent months.

As reported by Bitcoinist, Lyn Alden, the founder of Lyn Alden Investment Strategy, recently shared three reasons why she has allocated capital to BTC. They are as follows:

- Bitcoin’s network effects have allowed it to outpace altcoins, which could have suppressed BTC.

- Bitcoin has scarcity mechanisms such as block reward halvings.

- The cryptocurrency has an “ideal” macro backdrop, which includes massive growth in money supply and the mainstream adoption of the asset by prominent firms.

Where Could BTC Rally in the Long Run?

Pal thinks that Bitcoin could gain at least one order of magnitude in the upcoming bull cycle, announcing this target in a number of threads and interviews.

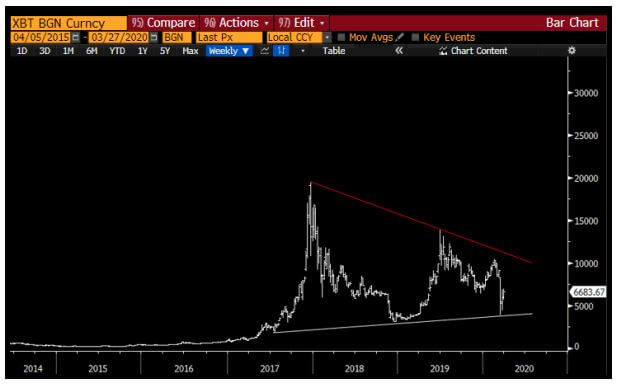

In an April newsletter, he wrote in reference to the price of BTC’s price action seen below:

“The chart is spectacular… I think it hits $100,000 in the next two years alone. But it could go to $1m in the same time period.”

In an interview with Max Keiser, Pal also mentioned there is a potential for Bitcoin to become a $10 trillion asset in the next decade.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Here's Why a Wall Street Vet Says "Everything" Is an Inferior Trade to Bitcoin

Post source: Here’s Why a Wall Street Vet Says “Everything” Is an Inferior Trade to Bitcoin

More Bitcoin News and Cryptocurrency News on TheBitcoinNews.com

from The Bitcoin News – Bitcoin and Blockchain News https://thebitcoinnews.com/heres-why-a-wall-street-vet-says-everything-is-an-inferior-trade-to-bitcoin/

0 Comments