FTX is one of the newest cryptocurrency exchanges that has gained so much popularity quickly. This article reviews the FTX exchange, looks at how it works, and why you may want to use it over other cryptocurrency exchanges.

Quick review of FTX

FTX exchange is a cryptocurrency derivatives exchange built by Alameda research, a group of professional traders. FTX offers different trading options from spot to unique derivatives, exclusive to the platform.

The trading platform has become very popular due to its unique yet simple design and very low trading fees.

Origins of FTX

The exchange launched in 2019, built by CEO, Sam Bankmam-Fried and CTO, Gary Wang. The idea behind FTX is to give users access to a platform” built by traders for traders.” FTX provides cryptocurrency traders with a similar experience, like major traditional trading sites.

A big name behind FTX is Alameda Research, a major liquidity provider that manages over $100 million in digital assets and over $600 million in trades across several products every day.

FTX platform overview

FTX exchange lets you trade spot, perpetual futures, leveraged tokens, options, and MOVE. Each product is unique and gives traders a wide range of options to make profits.

Here is a quick break down of the derivative products on FTX:

Spot: This is the most popular type of trading on crypto exchanges. It’s a market where orders are matched for assets.

Perpetual futures: Futures contracts allow traders to speculate on the price of an asset.

Leveraged tokens: These are unique tokens that give traders a leveraged exposure to crypto markets without opening leveraged positions.

Options: Options are used to protect against market volatility. They are special futures contracts that allow you to sell at a future strike price.

MOVE: A set of contracts based on the absolute change in value or price of a cryptocurrency over a weekly or quarterly period.

FTX has the broadest range of derivative products with massive liquidity. These derivatives are financial products that derive value from an underlying asset such as bitcoin and ethereum. FTX allows you to trade with high leverage of up to 101x.

Getting Started On FTX

Step #1 – Sign Up

You need to sign up on FTX.com to get started. (By using our FTX link, you get a 5% discount on trading fees).

After signing up, you are immediately asked to set up two-factor authentication (2FA) to add another layer of protection to your account. It’s not compulsory to set up 2FA. However, it is best practice to avoid a breach of your account.

Step #2 – KYC Verification

KYC verification is not required. You can withdraw only $1,000 without verification. To increase your withdrawal limit, you will need to verify your identity.

Here are the three levels of verification on FTX exchange:

- Level 0: email – $1000 lifetime withdrawal limit.

- Level 1: name and country of residence – $2000 daily withdrawal limit.

- Level 2: more personal details, proof of address and ID document – unlimited withdrawals

- Level 3: bank statement and recent proof of address – unlimited crypto and OTC withdrawals.

Step #3 – Deposit Crypto or Fiat

Go to your wallet on FTX to deposit crypto or fiat. Find the currency you want to deposit and send it to the address on your FTX exchange wallet.

You can deposit USD by sending stablecoins like USDC, PAX, HUSD, and TUSD to your wallet. Other traditional currencies supported include TRY, AUD, GBP, EUR, and HKD.

Further, you can buy bitcoin via credit card via Simplex. You can only do this if you have passed KYC verification level 2.

After making deposits, you can now start trading.

FTX Trading Fees

FTX exchange charges some of the lowest trading fees among the crypto trading platforms. Market takers pay a 0.07% fee, and market markers pay a 0.0% fee (For the rest of 2020).

The exchange has a 6 tier trading fee structure. Traders with a higher trading volume in the last 30 days are charged lesser trading fees.

What’s more, you can get up to a 60% discount on trading fees by using FTX Token (FTT). FTT is the native token of the FTX trading platform that comes with special utility.

Leverage trading increases trading fees. For instance, 100x leverage increases fees by 0.03%. Further, leverage token creation and redemption comes with a 0.01% fee. Traders are charged a 0.03% daily fee to manage leveraged positions.

FTX charges no deposit and withdrawal fees.

Trade DeFi coins on FTX:

FTX is keeping up with the trends as Decentralized Finance (DeFi) becomes the hottest thing. FTX is one of the exchanges that adds DeFi coins quickly. You can trade DeFi coins like balancer (BAL), sushi (Sushi), UNI (UNI), binance coin (BNB), Maker (MKR), and many more.

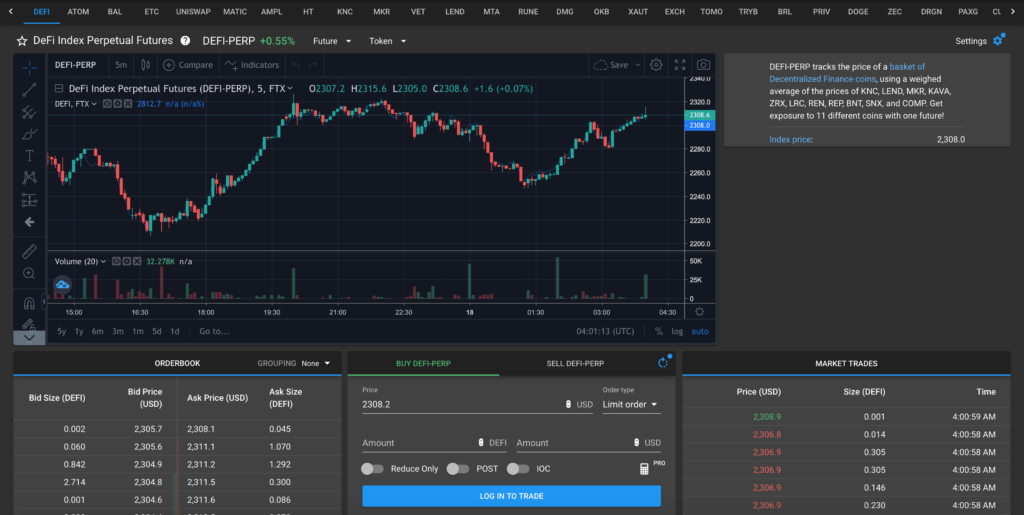

What’s more, FTX offers DeFi derivatives. The DeFi Index Perpetual Futures that tracks the price of a basket of DeFi coins. This product gives traders exposure to DeFi tokens through a single futures contract.

*Sign up on FTX – Use our link to get a 5% discount on trading fees.

Trade Politics on FTX

FTX has political futures, a trading product built around monumental events. With the USA 2020 elections drawing closer, you can speculate on the winner. For instance, the TRUMP-2020 (TRUMP) contract will expire at $1 if Donald Trump wins the election or $0 if he loses. You can trade other contracts for other candidates too.

Customer Support

FTX has a very detailed FAQ that is available in different languages. Also, the support team is always available on Telegram to provide support in 8 different groups and languages.

Frequently asked questions about FTX exchange:

What are FTX Bitcoin BEAR / BULL tokens?

Bitcoin BULL and BEAR tokens are unique leveraged tokens that have a 3X leverage to bitcoin. Bull tokens make traders profit when the price increases while Bear tokens are profitable when the price decreases. For instance, by buying a Bull token, a 1% increase in bitcoin price gives you a 3% increase.

What leveraged tokens are available on FTX?

There are leveraged tokens available at on FTX exchange for the following coins: BTC, BSV, XTZ, LINK, ALGO, XRP, BCH, EOS, BNB, ETC, HT, DOGE, DRGN, BTMX, ADA, EXCH, PAX, LEO, PRIV, XAUT, ATOM, ETH, OKB, LTC, SHIT, ALT, MATIC, TOMO, MID, MIDB, HTBE, TRYB, LEOB, USDT.

Where can I use FTX?

FTX is available in most places. However, FTT is not available to traders in Crimea, Cuba, Iran, Syria, North Korea, Antigua or Barbuda, and Sevastopol.

US citizens have to use FTX.us, a different version of the exchange.

Bottom line – Is FTX safe in 2020?

FTX has a positive security record. It has built a strong reputation in the cryptocurrency space, led by a highly respected team. Despite the quick rise to prominence, it’s still early to pronounce a verdict on FTX.

Regardless, FTX exchange is a great trading platform for people looking to trade a variety of cryptocurrency derivative products with lower trading fees.

The post FTX Exchange Review – The Next Best Trading Platform? appeared first on BlockNewsAfrica.

Post source: FTX Exchange Review – The Next Best Trading Platform?

More Bitcoin News and Cryptocurrency News on TheBitcoinNews.com

from The Bitcoin News – Bitcoin and Blockchain News https://thebitcoinnews.com/ftx-exchange-review-the-next-best-trading-platform/

0 Comments