- Chainlink holds above the critical support provided by the 50% Fibo in conjunction with the 100 SMA.

- LINK/USD could resume the uptrend as long as the price reclaims the position above $14 and holds the 50% Fibo support.

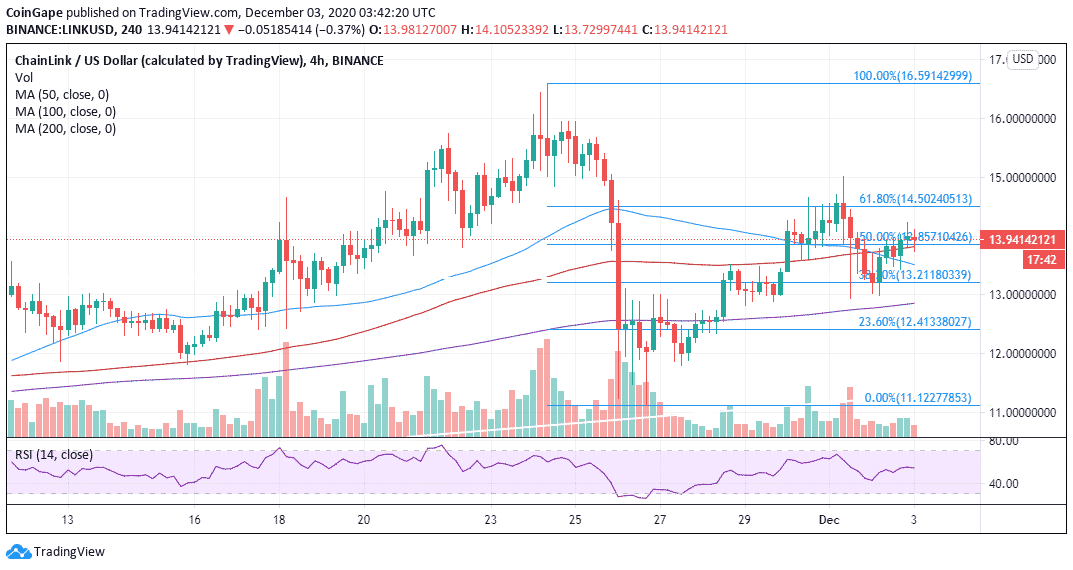

Chainlink’s upside recently hit a wall amid the recovery from the Thanksgiving Day crash to $11. Several barriers were pushed into the rearview but LINK failed to sustain gains above the stubborn resistance at $14.5. Meanwhile, it is still difficult to sustain the uptrend, now that the price slipped under $14.

Chainlink holds above critical support

At the time of writing, the decentralized oracle price feed token is trading at $13.9. Immediately on the downside, the 50% Fibonacci level is providing support. Additionally, the 100 Simple Moving Average on the 4-hour chart, adds credibility to the support.

Holding anchor above will cement the bulls’ position in the market while setting up Chainlink for a price action eyeing $18 in the medium term. As mentioned earlier several resistance levels are likely to delay the recovery, including $14.5, $15 as well as $16.

LINK/USD 4-hour chart

On the other hand, trading under the 50% Fibo and the 100 SMA might trigger massive sell orders. If enough volume is created, LINK would be forced to seek balance at the 50 SMA and the 38.2% Fibo. The bearish outlook has been reinforced by the Relative Strength Index after stalling slightly above the midline.

In case of extended declines, the 200 SMA is in line to cushion Chainlink from a massive drop. However, last week’s support at $11 would be the last resort before LINK enters into a downtrend with the potential of refreshing levels under $10.

Chainlink intraday levels

Spot rate: $13.9

Relative change: -0.034

Percentage change: -0.2

Trend: Short-term bearish bias

Volatility: Low

The post Chainlink recovery hampered under $14.5 but these key support levels hold the fort appeared first on Coingape.

from Coingape https://coingape.com/77191-2/

0 Comments